Last Updated on February 15, 2024 by Ben

Founded in 1989, GoldStar Trust Company is easily one of the world’s oldest and most established IRA companies. That long history makes people wonder just how good their service is. A GoldStar Trust Company review like this one is the likely source to find the answer.

Pros

- Over 30 years in the business

- The investors are doing business with a custodian.

- An inclusive IRA that has a wide range of alternative investment options.

Cons

- Very few customer reviews

- Neither sells precious metal assets nor places much emphasis on it

GoldStar Trust Company Management Team and Founders

GoldStar Trust Company initially began opening IRAs for clients and customers in 1989. The company markets and promotes itself as a leader in custodianship and self-directed IRAs. It also stated on its official company website that they act as a trustee and paying agent for clients.

The company offers unique investment solutions and retirement planning to people looking for alternative investments beyond mutual funds, stocks, and bonds. With the help of self directed IRA custodians, you can expect a great future in your retirement portfolio.

Despite being three decades old, GoldStar Trust Company remains one of the country’s smaller IRA firms and providers. It consists of a small yet highly experienced team of executives and employees.

On LinkedIn, GoldStar Trust lists 34 employees, but the exact number of people working under the company is unknown. Meanwhile, the executive team is led by three people — 3 different vice presidents.

Matt Peakes works as the Vice President of Business Development. Meanwhile, Dave Schnierle and John Johnson are the Senior Vice Presidents of Business Development. These three executive heads have experience in alternative investing through real estate investments and self-directed IRAs.

They do use their small size to their benefit. The company’s executive team prides itself on offering personalized and customized services to each client, ensuring quality retirement savings plans in the long term.

Investing Account Types Offered by GoldStar Trust Company

According to GoldStar Trust Company’s website, they offer investors four types of self-directed IRA accounts, along with several investing solutions.

GoldStar Trust Company Traditional IRAs

Similar to other traditional IRAs from other companies and providers, the ones from GoldStar Trust Company allows clients and investors to defer taxable income until retirement. That is assuming they withdraw after reaching 59 and a half.

GoldStar Trust Company Roth IRAs

A Roth IRA is a unique tax-advantaged IRA (individual retirement account) to which a person can contribute after-tax dollars. The main benefit of this account type is that the contributions and earnings can grow tax-free and be withdrawn at age 59 ½ tax- and penalty-free.

Roth IRAs are recommended for investors who believe they might have a high net worth upon retirement. The investors contributing to their Roth IRA cannot write these contributions off against their income taxes while they are still actively working.

However, they wouldn’t need to pay taxes upon retirement when they withdraw.

GoldStar Trust Company SEP IRAs

A Simplified Employee Pension (SEP) IRA is a basic retirement account that is very much like a traditional one. It is an easy-to-administer plan for anyone who owns a business, is self-employed, earns freelance income, or employs others.

As for the SEP IRAs at GoldStar Trust Company, they allow employers to contribute retirement accounts or funds on behalf of their employees. There is a huge benefit for employers in doing this. The contributions can be written off as a business expense.

There are, of course, terms and conditions worth considering, including paying a 10% fee for early withdrawals. That said, the penalties are not exactly a reflection on the company itself, as the IRS is the one to institute them.

GoldStar Trust Company Simple IRA

Simple IRAs are also available for employers with 100 employees or less. Similarly to SEP IRAs, employers can also write off their contributions to their employees’ pension accounts.

By 2020, employees can contribute a maximum amount of $13,500 to their accounts or plans. Simple IRAs also follow traditional IRAs’ rules so that they can write off contributions, and the taxes are deferred until withdrawn.

IRA Investing Options from GoldStar Trust Company

With over 37,000 IRAs and assets of more than $2 billion, it is easy to declare GoldStar Trust as one of the leading companies in its niche. One of the things that made it climb the ranks is its IRA investing options.

Like other self-directed IRA companies, GoldStar Trust Company also aims to provide various options and choices beyond traditional securities like bonds, stocks, and mutual funds. Here is a list of options that the company offers:

- Secured Promissory Notes

- Charter School Boards

- Perth Mint Certificates

- Structured Cash Flows

- Money Market and Mutual Funds

- Bank Certificates of Deposit

- Secondary Market Annuities

- Partnerships and Limited Liability Companies

- Extensions Funds and Church Loan

Other IRA companies and providers do not necessarily promote some options above, such as earning a return for supporting charter schools and churches and assistance from a self directed IRA custodian.

The company aspires to provide and offer an extensive range of exotic and unique investing options that other companies in the same industry do not offer. What’s most surprising and intriguing is that the company does not promote typical or usual commercial and residential real estate deals.

GoldStar Trust Company steered clear away from the standard and stereotypical to give way to other options that are less explored.

They did, however, indicate at the lowermost part of their sales page that investors who are interested in placing money in things that are not included or listed on their website can reach out to their investor services department. They can discuss the available options to see how to have those things in their IRA.

This creative way and approach to customer service make them highly appealing to their existing clients. This kind of personalized service is what the company genuinely prides itself on. It gives their investors the proper assurance that they truly have their best interests.

IRA Fees from the GoldStar Trust Company

GoldStar Trust Company has an extensive fee schedule available on its company website. Mutual funds, money market funds, and other publicly traded traditional securities all carry a $25 one-time establishment fee and an annual maintenance fee worth $65.

They also charge a hedge fund yearly asset holding fee ($50), a trading fee ($25) per trade, and brokerage fees. Despite having other various fees, the prices are relatively reasonable, especially compared to other companies and providers. It is common to pay at least $100-$200 yearly fees to smaller IRA companies when investing in traditional assets.

To make this more detailed than other reviews, here is a grand overview and breakdown of the way the company administers fees among several alternative types:

Real Estate

The company’s real estate fees include an initial account set-up fee ($50). There will be annual maintenance fees, but they depend on the real estate’s value in the account. The maintenance fee begins at $200 for those with properties less than $200,000.

Once an investment exceeds that amount, the maintenance fees would climb to $300 a year. The company charges $100 on the sale of real estate. $50-$100 is also set for separate administrative and legal fees for documents that are needed to be reviewed or rushed.

Precious Metals

There is a $50 set-up fee for a precious metals IRA. The maximum annual maintenance fee is $275 for accounts with a value of up to $100,000. There is also a minimum storage depository fee of about $100.

Fortunately, there is no charge for selling, purchasing, or exchanging assets within the IRA account. Any precious metals distribution has a payment of $40 plus shipping costs.

Perth Mint Certificates

For Perth Mint Certificates, the set-up fee is also $50. The following costs include a $40 fee on sales or trades of assets within the account, a $150 yearly asset holding fee, and a $75 yearly maintenance fee.

Annuities and Bank Accounts Outside of the United States

Investors can put money into accounts outside the U.S., where assets or funds can still be held within an IRA. For this specific service, the client will need to pay $275 in annual fees based on the account’s value and $50-$70 for surrendering annuities or liquidating assets.

Church Bonds and Church Loans

This part tends to surprise many investors and clients. GoldStar Trust Company allows its investors to buy church bonds and loans. It is a unique investment that barely any other IRA provider would consider promoting or offering.

Fees are $25-$50 for maintaining or shutting down the accounts related to or associated with any transfers or in-kind changes.

GoldStar Trust Company Support and Customer Service

The customer service team for the company is available from 7 am to 5 pm (Central Standard Time). Investors with inquiries or questions may also contact them by phone at 1-800-486-6888 or via email at [email protected].

Customer Reviews at GoldStar Trust Company

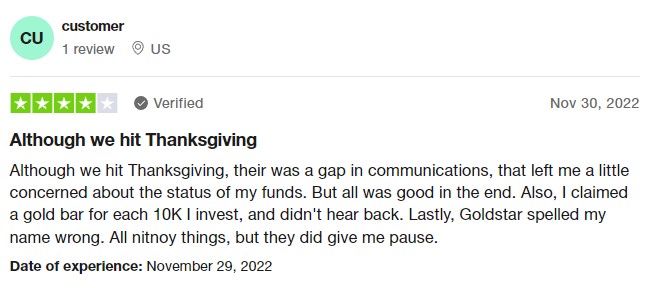

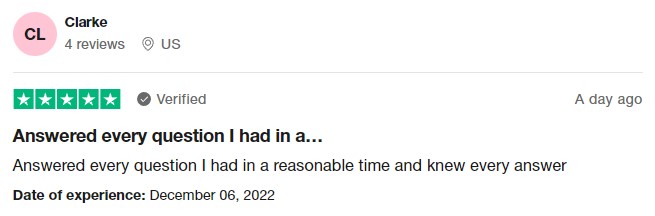

Even the highest-rated companies have a couple of criticism and complaints thrown in those walls of praise. Despite that, the company’s overall public image remains positive.

While it is not officially accredited by the Better Business Bureau (BBB), the company still maintains an impressive A+ rating. However, GoldStar Trust does not seem to garner many reviews online, so it is pretty hard to gauge how the customers see it.

The company scored only 1.9 out of 5 from 17 customer reviews on its Google Business profile.

Reviews from Trustpilot

FAQs for GoldStar Trust Company

1. Where is the Physical Headquarters of GoldStar Trust Company?

The physical head office of the company is found in Canyon, Texas.

2. What kinds of retirement accounts can you move into an IRA with GoldStar Trust Company?

GoldStar Trust Company offers various types of retirement accounts to investors, including SEP IRA, Simple IRA, Traditional IRA, and Roth IRA.

3. Is It Possible to take Possession of the Assets in My IRA?

While other IRA providers allow investors to maintain control of their assets via limited liability corporations, it isn’t something GoldStar Trust offers. The IRS is constantly looking to crack down on those who hold retirement-related assets in their homes, regardless of how they do this, so the company does not allow it.

4. Is A Property Manager Needed to Make Real Estate Investments?

Real estate investors with GoldStar Trust must work with property managers. The property manager must sign a formal agreement with the company to be officially registered property managers and profit from any gains they might be entitled to receive.

The company website contains all the answers to various other frequently asked questions. Most of these questions focus on the legalities related to real estate investments.

5. Should GoldStar Trust Company IRA Be Selected for your Self-Directed IRA?

GoldStar Trust Company is one of the oldest IRA companies standing. With its long history and extensive experience, it is easy to tell that they know what they’re doing.

Perhaps one of the best reasons to trust this company is that they are upfront and straightforward about their fees. Several other companies wouldn’t even dare display their price on their website, and the chance that they do, they would only show the bare-bones version.

GoldStar Trust is brave as they show off all fees for every investment they offer. That right there is a rare quality for IRA companies nowadays.

This company’s downside is that it doesn’t have as much market share as other companies. There are only a few publicly available customer reviews on GoldStar Trust. Unfortunately, many of these are negative.

Despite their Google Business profile being negative overall, they maintained an A+ rating on the BBB website.

GoldStar Trust is truly one-of-a-kind from an investor’s standpoint, offering some of the most unique and hard-to-find investment options. Though that is the case, an investor should still consider looking around for other smaller IRA companies before deciding.

Why Put Gold in Your IRA?

Gold is a dependable asset that can retain and even increase its value over time. With the world’s economy struggling through various scenarios (wars, inflation, shortages, etc.), investors are continuously uncertain about their assets and investments. Many investors protect themselves by placing physical gold in their IRAs.

Putting gold in retirement accounts appeals to many investors who wish to diversify their portfolios. It is mainly due to gold prices moving in the opposite way and direction of paper assets. Adding gold to an IRA provides an insurance policy against inflation.

A gold IRA prospers even during a crisis. Physical gold might be a high risk for some, but it’s to be expected. The world of investment has always been full of risks. One must be willing to take a large one to ensure financial security.

Alternatives

For those looking for other IRA providers or simply searching for one that sells precious metals, here are other options to consider:

American Hartford Gold

www.americanhartfordgold.com

Star Rating

American Hartford Gold is an excellent example of what a gold IRA company should be. They have an impressive reputation, positive feedback, and a high-quality product list. The company also certainly has the qualifications to be a leading company in the industry; comprehensive educational resources, competitive pricing, and an excellent buyback program.

This company is one that all investors can trust. It offers various customer benefits, though its price match guarantee sets it apart from other companies. They promise to match the prices of their competitors.

American Hartford Gold is a family-owned company located in Los Angeles, CA. They aim to help clients invest in precious metals, including gold, silver, and platinum. They offer physical deliveries straight to one’s home or within a retirement account like an IRA or 401(k).

The firm is genuinely dedicated to giving fair pricing and quality service. They aspire to help clients enhance their financial security and stability by adding more ‘safe haven’ assets to their retirement accounts.

Pros

- AA rating at BCA and A+ rating at BBB

- Investors can set up wealth-protecting IRA in 3 simple steps

- Buyback commitment

- Customer service is high-quality

Cons

- No mention of fees or prices on their website

- Does not do international shipping

Augusta Precious Metals

www.augustapreciousmetals.com

Star Rating

Augusta is one of the leaders in the pack when it comes to gold IRAs. According to its clients, the company has an outstanding track record, high customer satisfaction ratings, and consistently excellent performance. It is one of the best allies an investor can have when considering diversifying their retirement accounts and portfolios.

and established in 2012, Augusta consists of a knowledgeable team of precious metal professionals who aspire to help every client attain a solid retirement plan. They allow investors to set up and manage their IRAs, build their accounts, increase their holdings, and create financial stability for their families.

They are highly committed and dedicated to making the set-up process as easy as possible for new investors. The company offers assistance throughout the process, from the precious metal selection to the asset liquidation. It is sufficient to say that choosing Augusta means that an investor can expect and enjoy a high standard of long-term services.

Pros

- A+ rating over at Better Business Bureau

- Competitive pricing of precious metal assets, specifically gold and silver

- Lifetime customer support

- Free education

Cons

- High minimum investment

- Limited precious metals selection

Goldco

www.goldco.com

Star Rating

Operating since 2011, Goldco is a well-established precious metals company that specializes in gold and silver IRA retirement accounts. The firm is a member of the BBB with a stellar A+ rating and is fully licensed and insured to offer and sell precious metal assets.

Goldco is best known for its self-directed gold and silver IRAs that immensely appeal to investors looking for hands-off asset diversification. With Goldco, little guesswork is needed for setting up and managing IRAs. Every client is given an account administrator that will send them a catalog of available precious metal products.

The company is well-known for its fast delivery time. Having many locations in the country made delivering their services and products easy. Many investors have used their services for years, and most have only good things to say about the company and its products.

Many investors turn to Goldco for their evident dedication to providing only high-quality products and services. With many years of experience, Goldco gained enough knowledge to operate and go around in this industry.

Pros

- Positive and excellent feedback from over a thousand verified reviews

- Hands-off investing

- Solid reputation

- Worthwhile promotions

Cons

- Higher premiums on certain exclusive coins

- Fees and prices are not publicly available

Birch Gold

www.birchgold.com

Star Rating

Since most investment portfolios nowadays are primarily composed of stocks and bonds, it is hard to have a solid survival guarantee with unpredictable inflation looming ahead. Birch Gold stands to be a ray of sunshine in that sky of dark clouds by offering attractive investment options that can give its customers the peace of mind they need.

The Birch Gold Group is a precious metals IRA and investment firm founded in 2003. The company boasts more than 10,000 customers in the U.S. and abroad.

Birch Gold earned a stellar reputation by offering gold and other precious metal IRAs to its target audience. It garnered hundreds of positive customer ratings and reviews on various online platforms.

With almost 20 years of experience, this firm earned the right to call itself a top-rated company. The company is perfect for those looking for new ways to invest and protect their assets.

Pros

- Outstanding customer service

- Reasonable minimum purchase

- High ratings and positive reviews

- Experienced and knowledgeable team and staff

Cons

- Limited educational resources

- Only caters to U.S. investors

Final Thought – Gold Star Trust Company Reviews

The Gold Star Trust Company is a firm with unique investment options, transparent fee structures, and decades-long history and experience. It is a firm that small and newbie investors can trust with their assets.

While GoldStar Trust is not a scam, they are not technically the best for setting up precious metal IRAs. There are much better options for investors who wish to focus on precious metals investment.

Regarding choosing a company that focuses on precious metals assets, American Hartford Gold is one of the top choices. It is a gold and precious metals dealer specializing in IRA investments.

American Hartford Gold offers everything an investor will need when investing in precious metals. They have representatives that can answer any question regarding precious metals investments, extensive educational material for those willing to learn, and professionals that can guide investors at every step of the process.