Last Updated on March 17, 2024 by Ben

Regal Assets ‘At a Glance’ Analysis:

Regal Assets assists in giving your money the protection and growth it deserves. Investing will always be essential to your financial plan, whether for a short-term emergency or a long-term retirement. The three Regal Assets portfolios are designed to give you the flexibility you need to meet your short-term and long-term objectives. In their reviews, users have recommended Regal Assets as the best company to purchase metals for IRA growth.

Regal Assets Reviews

Regal Assets ‘At a Glance’ Analysis:

Regal Assets assists in giving your money the protection and growth it deserves. Investing will always be essential to your financial plan, whether for a short-term emergency or a long-term retirement. The three Regal Assets portfolios are designed to give you the flexibility you need to meet your short-term and long-term objectives. In their reviews, users have recommended Regal Assets as the best company to purchase metals for IRA growth.

Visit the Regal Assets website to learn more about your options for withdrawing money from the stock market and adding gold and silver to your retirement account.

Pros

- Credibility. a 17-year-old company whose excellent service keeps customers investing. Regal Assets has high BBB, BCA, and Trustlink ratings.

- Not Pushy. Unlike its competitors, the company does not pressure customers to buy collectibles to make more. Regal Assets provides IRA-approved, high-quality gold bullion.

- Fast shipping. After withdrawing bullion from storage, your gold will arrive at your door in a week. Regal Assets fails to deliver within a week, and you’ll get a free American Eagle silver coin.

- Buyback. The client owns the precious metal and is not required to sell it to Regal Assets. Regal Assets always buys precious metals, even though the law doesn’t need it. This company offers the highest buyback price on a trading day without liquidation fees.

Cons

- Some fees and price information were difficult to find on their corporate website.

There have been some negative reviews posted online.

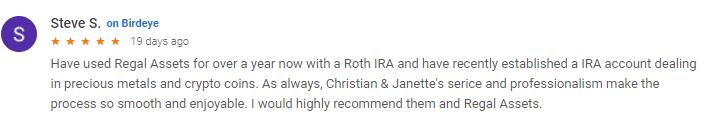

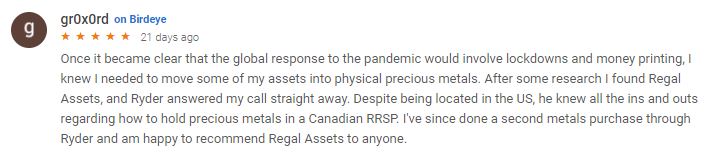

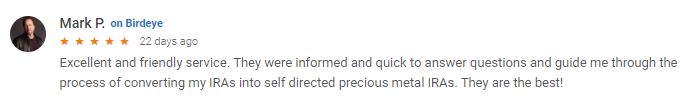

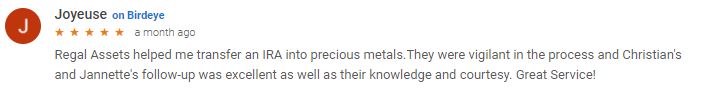

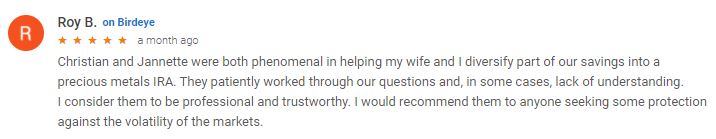

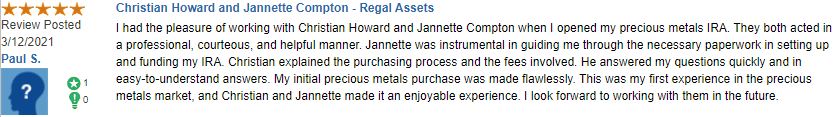

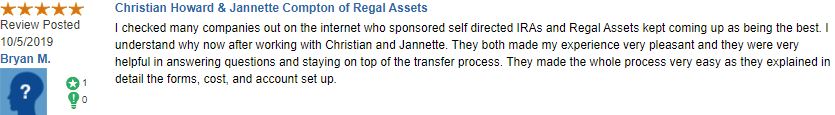

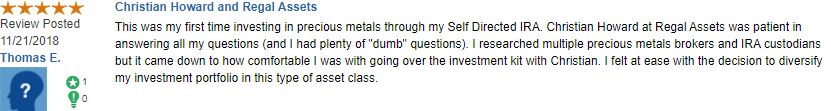

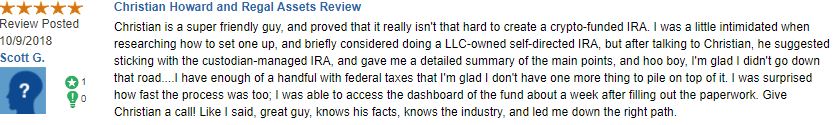

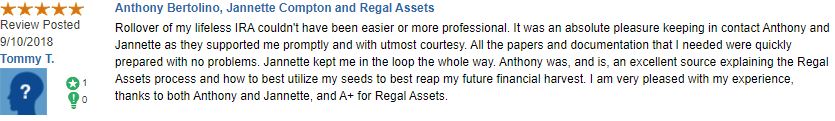

Reviews and Testimonials

Birdeye Customer Reviews

4.9

4.5

What is Regal Assets

Regal Assets sells precious metals for investment, and they can help you open a gold IRA and trade precious metals. People invest in gold and other precious metals because stocks, mutual funds, and treasuries are volatile.

A gold IRA is a type of retirement plan in which people purchase gold for profit or retirement. This investment also receives tax breaks. Attracts investors, and Regal Assets also offers portfolios for investors with different goals. It could be a collection of precious metals such as gold and silver, and it could also be a mix of gold and cryptocurrency—which balances the investment’s risks and returns.

Regal Assets is an alternative asset investment firm that specializes in a proprietary IRA that can be used to invest in both precious metals and cryptocurrencies. The company offers segregated, secure vault storage for your precious metals, as well as links to Franck Muller Encrypto watches on its website.

Aside from that, Regal Assets knows how to look after its customers. They provide excellent customer service, have no hidden or unnecessary fees, and their buyback offer demonstrates that they value their customers.

Here’s the list of products the Regal Assets offered (AP News, 2020):

- 1 oz Gold British Britannia Coin

- 1 oz Gold Australian Kangaroo Coin

- 1 oz Gold Canadian Maple Leaf Coin

- 1 oz Gold American Eagle Coin

- 1 oz Gold American Buffalo Coin

- 1 oz Gold Austrian Vienna Philharmonic

- 1 oz Gold Chinese Panda

- 1 oz Gold South African Krugerrand

- 1 oz Gold Islamic 8 Dinars Coin

- 1 kg Gold London Good Delivery List Bar

- 10 oz Gold London Good Delivery List Bar

- 1 oz Gold London Good Delivery List Bar

- 1 kg Al Etihad Gold Bar

- 1 kg Emirates Gold Bar

Aside from gold, Regal Assets also offers silver, platinum, and palladium:

- 1 oz Silver American Eagle

- 1 oz Silver Canadian Maple Leaf Coin

- 1 oz Silver British Britannia Coin

- 1 oz Silver Austrian Philharmonic Coin

- 1 oz Silver Australian Kookaburra Coin

- 1 oz Silver Australian Koala Coin

- Kilogram Silver London Good Delivery Bar

- 100 oz Silver London Good Delivery Bar

- 10 oz Silver London Good Delivery Bar

- 1 oz Platinum American Eagle Coin

- 1 oz Platinum Canadian Maple Leaf Coin

- 1 oz Platinum Australian Koala Coin

- 1 oz Palladium Canadian Maple Leaf Coin

- 10 oz Palladium PAMP Bar

- 1 oz Palladium PAMP Ba

Regal Assets History

Tyler Gallagher, a young entrepreneur and investor, founded “REGAL ASSETS,” a top US crypto and gold investment company, over 12 years ago to help investors. Regal Assets, founded in 2009, is a major US alternative asset company. CEO Tyler Gallagher has grown his Beverly Hills-based startup into a global enterprise with offices in the US, Canada, and the UK.

Since 2010, the company has maintained a rare “A+” Better Business Bureau rating. Regal Assets is an obvious choice for investors looking for a simple and secure IRA gold and precious metals investment.

In 2013, the company had become an INC 500 company, ranking #20 in the United States for financial services. In 2017, the company added cryptocurrencies to its product line, making RA one of the first to provide a “bitcoin IRA” for US investors.

Mission

Regal Assets aims to be every investor’s one-stop shop for metals and cryptocurrency investing. On the other hand, the company specializes in assisting individual investors in incorporating metals and cryptocurrency into their investment portfolios and retirement accounts. Indeed, since its inception, the company has aided thousands of Americans in converting their existing IRA, SEP, 401(k), 403(b), or TSP plans to metals and cryptos.

Regal Assets also offers a diverse range of products for investors who want to buy outside their retirement or investment accounts.

Investment Packages

Regal Assets are great for diversifying and planning. Before making any decisions, read verified regal asset reviews. These reviews provide an unbiased assessment of Regal Assets’ investment packages and customer service.

These investment packages offered by Regal Assets are divided into two:

For Protection and Security:

The package provides investors a secure and dependable way to invest their money. It considers your risk tolerance, investment goals, and diversification strategy. Includes access to professional financial planners who can help you make the best decisions for your unique situation.

Merchant Package (Cost: $5,000)

This investment is easy to liquidate for people who want to put their money in a safe place. It is available whenever the investor needs cash right away. According to the regal asset reviews, it’s an excellent way to diversify your portfolio, and you can get professional advice.

Knighthood Package (Cost: $10,000)

The package is similar to life insurance for a loved one. It offers protection during family emergencies. It can last up to three months for a family of four. It accepts investments in both gold and silver. According to Regal asset reviews, this package is an excellent way to protect your family’s finances.

For Investment and Retirement:

With this package, you can invest in various assets, including stocks, bonds, and mutual funds. You get access to professional advisors who can help you make sound investment decisions. Includes services for retirement planning when you are ready to retire. The idea of rolling over retirement funds into a self-directed IRA can be intimidating.

Legacy Portfolio (Cost: $25,000)

The portfolio is for investors who want their profits to grow more quickly. It includes both precious metals and cryptocurrencies. The consistent rise in the price of metals and the volatility of cryptos create a balance of earnings. The favorable package indicates that it is an excellent way to diversify.

Kingship Portfolio (Cost: $50,000)

Metals and cryptocurrency are included to achieve both stability and growth, used to protect your assets from inflation while also assisting you in making short-term profits. The terms of the package are also favorable, indicating that it is an excellent way to protect your finances.

Dynasty Portfolio (Cost: $100,000)

They are generally used for long-term investments and retirement. It provides stability, inflation protection, and a higher rate of return. The benefits of this package indicate that it is an excellent way to save for the future.

Coronation Portfolio (Cost: $250,000)

It meets wealthy people’s long-term and short-term financial objectives. Metals and cryptocurrencies continue to exist, and Regal asset reviews show that the package provides a good return on investment.

Why You Should Invest in Regal Assets

Regal Assets reviews show why it’s a top precious metal investment. It sells gold, silver, palladium, and platinum coins and bars and has a history of customer satisfaction. Investors like royal assets because its secure online platform lets you access them anywhere, and its royal vault secures storage. Regal Assets is the perfect partner for diversifying your portfolio, hedging against inflation, or adding sparkle to your savings.

The Use of Segregated Storage

It provides clients with a separate storage facility for their purchased gold and other precious metals. In addition, the annual fee is only $150, as opposed to the market standard of $250. Is there another regal asset review emphasizing the security of your investments? Furthermore, regal assets offer customers various insurance options to ensure their valuable metals are always safe and secure.

No Hidden or Variable Fee Structure

A flat fee of $250 is charged regardless of the amount invested. Aside from that, no fees are required. Regal asset reviews are a good sign because there are no hidden costs for investors. Regal assets ensure that all customers understand what they’re getting into when they invest by using a transparent fee structure.

Fees for Regal Assets Gold IRA

Over the years, Regal Assets has collaborated with a number of the leading custodians and vault storage facilities. They employ CNB Custody as their preferred self-directed IRA custodian and Brinks Global Services as their partner vault storage provider.

You should anticipate paying a fixed cost of $125 per year for segregated vault storage and a flat $90 per year for custodian fees to CNB with a Regal gold IRA account.

This comes to a total of $215 every year to keep your Regal IRA in IRS compliance.

Important: Regal Assets will pay all first-year costs (as well as account setup fees) for your new gold or cryptocurrency IRA accounts. The annual storage and custody fees of $215 do not become payable until the second year that your precious metals IRA is operational.

Fast Shipping and Quick Processing Time

They ensure that the client’s investment withdrawal is processed and delivered to their door within a week. Otherwise, they will give you a free silver American coin. Their effectiveness ensures customer satisfaction and another regal asset review that emphasizes their dedication to providing excellent customer service.

Is Regal Assets a Trustworthy Company?

Regal Assets is a well-known financial services firm operating since 2009. It has received recognition from the Forbes Finance Council and the Inc. 500. It has thousands of happy customers and the admiration of industry leaders.

The company distinguishes itself through its knowledge and experience in setting up these accounts in accordance with IRS tax rules. You should know that Regal Assets offers fully insured and secure cold-storage of crypto holdings as per IRS tax rules.

Fees and Pricing

Fees and Pricing for Regal Assets In their 13+ years of operation, the Regal Assets team has served thousands of customers across the United States. During this time, they’ve established relationships with the industry’s top self-directed IRA custodians and vault depository firms. They’ve also been able to reach agreements with the industry’s top self-directed IRA custodians and vault depository firms. They’ve also been able to negotiate fees for their customers, making their gold and cryptocurrency IRA offerings very competitive with what others in this space are offering. If you want the most up-to-date information on Regal Assets fees, call them at 1-877-962-1133 or sign up for a free startup kit.

Buy-Back Program

You should keep your Regal IRA account but occasionally take distributions or sell metals. Deliver your precious metals to your home or other location. In seven days, Regal can ship metals from your IRS-approved depository to any US location. Regal Assets safeguard all metals.

According to some research, Regal Assets has one of the best precious metals buy-back programs. Some gold IRA companies claim to pay top dollar for your metals but charge additional fees and use other deception to profit during the buy-back process. Ask Regal Assets’ account representative about their buy-back program and compare it to other dealers. Get gold IRA fees in writing.

How to Invest in Regal Assets

Regal Assets provides two of the most dependable and time-tested gold investment options:

1. Purchasing gold and having it delivered to you is the most common method of investing in gold.

Purchasing gold coins or bars, also known as gold bullion, is one of the most emotionally rewarding ways to invest in it. You’ll enjoy touching and viewing it. Gold bullion is purchased in various ways, from a local gold collector, dealer, or online through JM Bullion or APMEX. Furthermore, pawn shops may sell gold. Keep an eye on the spot price of gold while buying to ensure you get a good deal. You should invest in gold bars rather than coins because the coin’s collector value will almost certainly outweigh the gold content.

2. Investing in gold through a gold IRA has outperformed other paper investments, such as the stock market and real estate, in the past.

A Gold IRA works similarly to a traditional IRA, with the same distribution rules and investment limits. Unlike its competitors, a Gold IRA is intended to hold physical gold bullion in the form of bars or coins, as well as other permitted precious metals such as palladium, platinum, and silver, rather than paper financial assets such as bonds and stocks. Although the custodian an IRS-approved financial institution, several mutual funds, and financial services companies that handle traditional IRAs do not offer self-directed IRAs. You must also select a precious metals dealer to manage your IRA’s gold purchases.

Remember that not all self-directed IRA custodians offer the same investment options, so check to see if they provide physical gold before opening an account. Contributions, transfers, or rollovers from qualified plans such as 401(k), 403(b), or 457 must be made to the account, subject to contribution limits. You can then choose your investments, and your dealer and custodian will handle all transactions on your behalf.

Is Regal Assets Legit?

Regal Assets is a safe and secure way to invest in precious metals and cryptocurrency. Including these investments in your portfolio can assist you in diversifying your wealth and planning for retirement. Regal Assets has thousands of happy customers and the admiration of industry leaders.

Adding precious metals and cryptocurrency investments to your portfolio can help you diversify your wealth and prepare for retirement. However, no investment is without risk, and the long-term viability of cryptocurrencies is uncertain.

Reputation & Complaints

Online Regal Assets reviews reveal overwhelmingly positive customer feedback and ratings for the precious metals IRA firm. Additional Details on Regal Assets Unlike other firms in the gold IRA industry. Regal Assets is a growing company that has made significant progress since its inception.

Regal Assets

Bottom Line

Regal Assets assists in giving your money the protection and growth it deserves. Investing will always be essential to your financial plan, whether for a short-term emergency or a long-term retirement plan. The three Regal Assets portfolios are designed to give you the flexibility you need to meet your short-term and long-term objectives.

Overall Rating:

CUSTOMER CARE

PRICE

RELIABILITY

EASE OF PURCHASE

Regal Assets

Bottom Line

Regal Assets help to provide your money with the protection and growth they deserve. Be it a short-term emergency or a long-term retirement plan, investing will always be an essential part of your financial plan. The three Regal Assets portfolio is designed to provide you with the flexibility to meet your short-term and long-term goals.

Overall Rating:

CUSTOMER CARE

PRICE

RELIABILITY

EASE OF PURCHASE

Alternatives

IRA Regal In the United States, the first Alternative Assets IRA, Regal IRA, was launched in July 2018. Regal Assets IRA is the WORLD’S FIRST alternative assets IRA, allowing people to invest in both HARD (metals like gold and silver) and DIGITAL (cryptocurrency) assets.

Regal Assets is a fantastic company. There are alternatives if you cannot do business with them for whatever reason. Goldco, Augusta, and American Hartford Gold Group are some of the options.

American Hartford Gold

www.americanhartfordgold.com

Star Rating

While many different types of gold coins are available for purchase, one of the most popular is the American Gold Eagle. The United States government mints and issues these coins, which vary in face value depending on the year.

Helpful information for anyone interested in precious metal coins but knows little about them. You can learn more about the various currencies this company offers on its main website.

The company offers a diverse selection of precious metals, coins, and bars. On the homepage, you can easily find what you need, and there is valuable information that can educate you about how it works.

Augusta Precious Metals

www.augustapreciousmetals.com

Star Rating

Augusta Precious Metals works with customers to set up self-directed IRAs for gold and silver. They deliver the metal to a safe storage facility. The company advises customers on what to do with their gold IRA. The company’s website contains information such as videos and articles. It also includes a calculator to help you determine when you should withdraw funds from your IRAs. The company also offers free online lessons. They discuss economics and work for the company. The company collaborates with the Royal Canadian Mint to produce coins for the United States. They are superior to other mints because they are purer and less expensive. The company is technologically savvy and offers an online chat option where you can interact with them.

Joe Montana, the company’s corporate ambassador, is a Hall of Fame quarterback. He assisted in determining which gold companies in the United States were reliable. They chose Augusta because of its clean and well-organized system and reputation for honesty and adherence to the rules. Augusta donates a portion of its profits to K9s for Warriors.

Augusta has knowledgeable agents and people who can assist you with the process. They are superior to other businesses because they do not make mistakes. Customers deal with a single personal agent. They will be speaking with a member of the Harvard Business Analytics Program, and they may also be working with members of the IRA processing team or the order desk. Augusta Precious Metals is the most trusted gold IRA company recommended.

Goldco

www.goldco.com

Star Rating

Goldco self-directed IRAs are ideal for investors looking for hands-off asset diversification. Although they are limited to a single asset class, these IRAs provide investors with a hedge against paper investments through precious metals investments.

If Regal Assets Company is the best for IRA Rollovers, Goldco is well-known for providing excellent customer service. Goldco Precious Metals is one of the few gold IRA providers that organize and disclose investment information to gain clients’ trust. They are known for providing excellent customer service. Goldco clients receive white-glove service in all their transactions, including complete contact with a specialist who will assist them throughout the process. Clients of Goldco are also encouraged to take advantage of the extensive educational resources available on their website.

Final Thoughts – Regal Assets

Finding the best gold and precious metals provider constantly challenges customer segments. Choosing a trustworthy and dependable provider can take time and effort, especially with many sellers claiming to offer the best deals. There are numerous factors to consider when evaluating gold and other precious metals providers. Among these factors are credibility, track record, available payment methods, price transparency, absence of fees and commissions, customer service, and delivery speed.

When all factors are considered, Regal Assets are significant. They have 99% customer satisfaction, and each customer has their storage. The company also makes sure that shipping and processing are quick and straightforward. Regal Assets is also well-known for its knowledge of IRA rollovers. Finally, regardless of the value, the company charges flat rate fees.